Wednesday, January 5, 2011

Tuesday, December 28, 2010

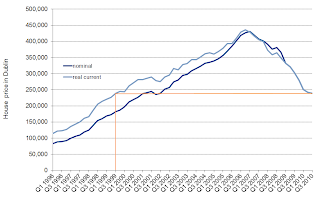

House prices in Ireland

unrelated to energy, but I wanted to record these charts somewhere.

House prices in Dublin since 1996.

Monday, March 22, 2010

Brazil oil production

Article this morning, says Brazil are going to invest $200 billion in developing oil reserves over the next 5 years .... that's a big big number.

Slide 34 on this presentation suggests that they aim to double production by 2020 to 4 million barrels per day ... which would bring it Iran's current level of production.

Slide 34 on this presentation suggests that they aim to double production by 2020 to 4 million barrels per day ... which would bring it Iran's current level of production.

Sunday, December 27, 2009

RE < C

When all the external costs (climate change and other environmental and health effects) of fossil fuel generation are accounted for many renewable technologies are cheaper than fossil fuel alternatives.

As markets don't price these externalities, governments provide subsidies for renewable electricity. However, government's generally only set subsidies at the level where renewable electricity is marginally profitable (government's generally do not want to spend excessive amounts of money on subsidies and be seen to fund private profits).

Making money from investing in renewable electricity is therefore very difficult. The real breakthrough (and profit!) will be when renewable electricity is cheaper than fossil fuels - or as Google puts it when:

RE < C

Until then investing in renewable electricity is about finding the location with the best subsidies.

As markets don't price these externalities, governments provide subsidies for renewable electricity. However, government's generally only set subsidies at the level where renewable electricity is marginally profitable (government's generally do not want to spend excessive amounts of money on subsidies and be seen to fund private profits).

Making money from investing in renewable electricity is therefore very difficult. The real breakthrough (and profit!) will be when renewable electricity is cheaper than fossil fuels - or as Google puts it when:

RE < C

Until then investing in renewable electricity is about finding the location with the best subsidies.

China, India & oil demand

One common way of forecasting future oil demand is linking GDP and oil consumption. The standard outcome of this kind of analysis is that China & India's growth is going to lead to massive increases in oil demand in future years.

This chart of population density across the world made me wonder if there is another factor. Oil is predominantly a transport fuel. India and Eastern China have extremely high population densities. When people live closer together they need to drive less. This may temper the growth of demand in India and China somewhat.

These gapminder charts (all with log scales !) show that although the link between GDP & oil consumption is strong, there is a definite link between oil consumption and population density also.

This chart of population density across the world made me wonder if there is another factor. Oil is predominantly a transport fuel. India and Eastern China have extremely high population densities. When people live closer together they need to drive less. This may temper the growth of demand in India and China somewhat.

These gapminder charts (all with log scales !) show that although the link between GDP & oil consumption is strong, there is a definite link between oil consumption and population density also.

Sunday, October 25, 2009

Cows & CO2

How much do methane emission from livestock (predominantly cows!) contribute to global warming. These emissions are politely called ruminants. Stephen Levitt's new book "Superfreakanomics" (which is getting alot of coverage currently) states:

"The world's ruminants are responsible for about 50 percent more greenhouse gases than the entire transportation sector"

.... really ?

Methane accounts for about 16% of global GHG emissions. How much of this is from ruminants ? I found it difficult to get an exact figure. This source implies 40% is from natural sources. US EPA data says that about 24% of the US's methane are from ruminants. So, going with the higher figure, ruminants account for about 4%.

Transport emissions are about 13.5% of total looking at this graph. The graph also confirms my calculation is roughly right... by stating that about 5% of GHG emissons are attributable to livestock. So, much as I like Stephen Levitt's work .... in this case I think he is way out !

"The world's ruminants are responsible for about 50 percent more greenhouse gases than the entire transportation sector"

.... really ?

Methane accounts for about 16% of global GHG emissions. How much of this is from ruminants ? I found it difficult to get an exact figure. This source implies 40% is from natural sources. US EPA data says that about 24% of the US's methane are from ruminants. So, going with the higher figure, ruminants account for about 4%.

Transport emissions are about 13.5% of total looking at this graph. The graph also confirms my calculation is roughly right... by stating that about 5% of GHG emissons are attributable to livestock. So, much as I like Stephen Levitt's work .... in this case I think he is way out !

Tuesday, October 6, 2009

DB: Is the age of oil coming to an end ?

Today Deutsche Bank released a report claiming the end of oil is nigh:

http://blogs.ft.com/energy-source/2009/10/06/deutsche-the-end-is-nigh-for-the-age-of-oil/

The report is certainly thought-provoking, there are a couple of things I would disagree with.

Future Demand

The report suggests (DB suggest that demand will fall from 84 million barrels per day currently to 79 million barrels per day in 2030. This is in contrast with IEA / EIA estimates of around 110+ million barrels per day in 2030.

If we remained as oil intensive per unit GDP as we are today, we would be around 130 million barrels per day in 2030 ... although it is likely that electrification / efficiency will mean this level is not achieved, I think the chances of demand actually falling are slim.

What about climate change ? Won't that require us to having falling oil demand ... well not according to the 450 ppm CO2 stabilization scenario that the IEA published in its 2008 WEO ... that still foresaw an increase in demand to 2030.

OPEC's behavior

DB also suggest that oil supply will remain tight due to the under-investment leading (among other factors) to peak supply in 6 years and $175/barrel oil. However, I think OPEC are well aware of the potential damage they will do if they don't invest in new supply to keep prices down. OPEC are aware of the consequences of $100+/barrel ... and I think will act to ensure enough of their vast reserves come online to ensure that prices don't sky-rocket in the long term

Summary

All in all I think it is a thoughtful report ... certainly food for thought for people who think oil demand and oil prices can only go up. Future demand is uncertain ... future supply is even more so - which means the intersection of these (the future price) is very difficult to predict.

http://blogs.ft.com/energy-source/2009/10/06/deutsche-the-end-is-nigh-for-the-age-of-oil/

The report is certainly thought-provoking, there are a couple of things I would disagree with.

Future Demand

The report suggests (DB suggest that demand will fall from 84 million barrels per day currently to 79 million barrels per day in 2030. This is in contrast with IEA / EIA estimates of around 110+ million barrels per day in 2030.

If we remained as oil intensive per unit GDP as we are today, we would be around 130 million barrels per day in 2030 ... although it is likely that electrification / efficiency will mean this level is not achieved, I think the chances of demand actually falling are slim.

What about climate change ? Won't that require us to having falling oil demand ... well not according to the 450 ppm CO2 stabilization scenario that the IEA published in its 2008 WEO ... that still foresaw an increase in demand to 2030.

OPEC's behavior

DB also suggest that oil supply will remain tight due to the under-investment leading (among other factors) to peak supply in 6 years and $175/barrel oil. However, I think OPEC are well aware of the potential damage they will do if they don't invest in new supply to keep prices down. OPEC are aware of the consequences of $100+/barrel ... and I think will act to ensure enough of their vast reserves come online to ensure that prices don't sky-rocket in the long term

Summary

All in all I think it is a thoughtful report ... certainly food for thought for people who think oil demand and oil prices can only go up. Future demand is uncertain ... future supply is even more so - which means the intersection of these (the future price) is very difficult to predict.

Subscribe to:

Posts (Atom)